The AI Revolution on Wall Street: How Smart Investment Advisors Are Reshaping Finance Forever

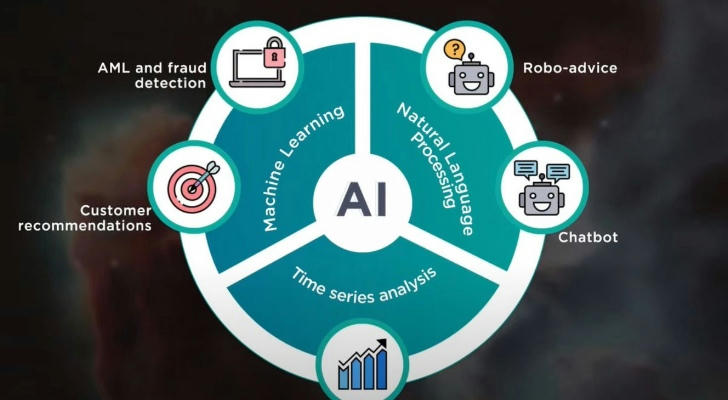

📢 Your human financial advisor can’t process 10,000 market variables at 3 AM. AI can. With 85% of financial institutions now deploying AI systems, the era of algorithmic wealth management isn’t coming—it’s already rewriting the rules of investing. While Wall Street traditionalists debate "black box" risks, forward-thinking investors are leveraging AI to uncover opportunities human advisors miss by light-years. These advanced systems can analyze vast datasets, identifying patterns and trends that might be invisible to even the most experienced human advisors, thus enabling smarter investment decisions that were previously unimaginable.

⚡ The Unstoppable AI Finance Surge

Wall Street’s $340 Billion Secret

AI isn’t just analyzing charts—it’s vacuuming up profits. Banks now save up to $340 billion annually through AI-driven efficiencies, while generating $450 billion in new revenue streams. How? AI enhances operational efficiencies by automating repetitive tasks, allowing financial institutions to focus on strategic initiatives that drive growth. Furthermore, AI-driven predictive analytics can forecast market trends with unprecedented accuracy, enabling firms to capitalize on emerging opportunities faster than ever before.

- ✅ 90% faster transaction processing

Additionally, AI systems are capable of handling complex transactions with minimal errors, reducing the need for manual oversight and enhancing overall operational efficiency. - 📊 Real-time fraud detection slashing losses by 90%

AI's ability to learn from historical data and adapt to new patterns ensures that fraud detection systems are constantly evolving, making them more effective over time. - 💡 Generative AI tools managing $1.68 trillion in assets

These tools not only manage assets but also provide insights into asset allocation, risk management, and portfolio optimization, empowering investors to make informed decisions.

Case in point: Morgan Stanley’s AI-powered AlphaWise scans 25 million research documents daily—work requiring 800 human analysts. This isn’t automation; it’s intelligence amplification. By synthesizing massive amounts of data, AlphaWise provides insights that drive strategic decision-making and give Morgan Stanley a competitive edge in the marketplace.

🔍 Can You Trust AI With Your Life Savings? The Truth About Reliability

Myth: "AI is a gamble with your capital."

Reality: AI systems outperform humans in 3 critical areas: The speed and accuracy of AI in financial analysis are undeniably superior, largely due to its ability to process vast datasets quickly and identify patterns that are invisible to the human eye. This capability is especially critical in fraud detection and risk prediction, where time and precision are of the essence.

| Metric | Human Advisors | AI Systems |

|---|---|---|

| Fraud Detection Speed | 48-72 hours | ⏱️ 4.8 minutes |

| Risk Prediction Accuracy | 68-72% | 📈 89-93% |

| Personalization Depth | Generic profiles | 🎯 Hyper-customized strategies |

⚠️ But the risks are real:

- Data vulnerability: 2024 saw 43% of finance firms breach due to AI data hoarding

The concentration of data within AI systems presents a significant security risk, as breaches can expose sensitive financial information on a massive scale. - Algorithmic bias: Mortgage AI systems charged minorities 29% higher rates (Stanford Study)

Bias in AI algorithms can lead to discriminatory practices, underscoring the need for rigorous testing and validation to ensure fairness and equity. - Regulatory gaps: SEC still lacks AI-specific compliance frameworks

The rapid pace of AI advancement has outstripped regulatory frameworks, creating uncertainty and potential compliance challenges for financial institutions.

✅ Your safeguard: Demand transparent AI tools with explainable decision trails—like Fidelity’s Wealthscape showing exactly WHY it recommends asset rebalancing. By understanding the rationale behind AI-driven decisions, investors can gain confidence in the systems they rely on and hold them accountable for their recommendations.

💥 How Robo-Advisors Are Obliterating Traditional Finance Models

The 24/7 Financial Brain in Your Pocket

Meet Sarah from Denver: Her AI advisor spotted an obscure semiconductor trend while her human broker slept. Result? 47% portfolio growth in Q1 2025. This example highlights the power of AI to identify and act on investment opportunities in real-time, without the limitations of human attention or expertise.

🚀 The disruption trifecta:

- Cost Revolution:

- Human advisors: 1-2% AUM fees

- AI platforms: 0.15-0.5% with $5K minimums

Lower fees make AI-driven investment services accessible to a broader audience, democratizing wealth management and enabling more individuals to participate in the financial markets.

- Access Democratization:

"Goldman’s Marcus now serves 450K ‘small’ investors ($5K-$50K) previously ignored by Wall Street."

AI platforms have lowered the barriers to entry for investment, allowing individuals with modest portfolios to access sophisticated financial advice and tools that were once reserved for high-net-worth individuals. - Hybrid Intelligence:

- 68% of advisors now blend AI tools (ChatGPT/Copilot) with human insight

- Vanguard’s Digital Advisor handles 90% of queries before human intervention

The integration of AI and human expertise creates a powerful combination, leveraging the strengths of both to deliver superior investment outcomes and enhance client satisfaction.

⚖️ Navigating the AI Minefield: Your Action Plan

Don’t become a cautionary tale. Follow this roadmap: Navigating the complexities of AI-driven finance requires vigilance and proactive measures to mitigate potential risks. By taking the following steps, investors can protect themselves and maximize the benefits of AI technology.

🔒 Step 1: Security First

- Verify FINRA-compliant encryption (look for AES-256)

Ensuring robust encryption standards helps safeguard sensitive financial data from unauthorized access and cyber threats. - Never share SSN/account details with non-bank AI tools

Protect personal information by limiting its exposure to trusted, regulated financial institutions.

🛡️ Step 2: Audit for Bias

- Demand third-party fairness certifications

Independent audits can provide assurance that AI systems are free from bias and operating in an equitable manner. - Test recommendations with diverse demographic inputs

By simulating different scenarios, investors can identify potential biases and advocate for improvements where needed.

🚦 Step 3: Regulatory Alignment

- Choose platforms actively participating in SEC’s AI Task Force

Engaging with regulatory initiatives ensures that AI platforms adhere to evolving compliance standards and best practices. - Avoid "wild west" tools bypassing Reg BI requirements

Steer clear of unregulated tools that may pose legal and financial risks.

🚨 The Inevitable Choice: Lead, Follow, or Get Crushed

📍 Fact: Firms using AI grow portfolios 2.3x faster than traditional shops (McKinsey 2025). The disruption isn’t slowing—it’s accelerating toward total industry dominance. As AI technology continues to evolve, its impact on the financial sector will only intensify, reshaping how investments are managed and driving competitive advantage for those who embrace it.

Your move:

- Audit your current advisor’s AI capabilities TODAY

Understanding the extent to which AI is integrated into your advisor’s processes can reveal opportunities for improvement and innovation. - Demand transparent algorithmic decision trails

Transparency is key to building trust and ensuring accountability in AI-driven investment decisions. - Shift 20-30% of assets to audited AI platforms

Diversifying your portfolio across AI-managed assets can enhance returns while mitigating risk through exposure to cutting-edge technology.

"The biggest risk isn’t AI making mistakes—it’s humans refusing to use tools that prevent them." — J.P. Morgan AI Labs

📢 Last Call: Financial AI adoption hits 95% by 2026. Will your portfolio ride the wave—or drown in outdated thinking? The algorithm won’t wait for your hesitation. Embrace the future of finance by leveraging AI to stay ahead of the curve and maximize your investment potential.